BenefitGuard

Nobody eliminates 401(k) cost, risk, and work like we do

Description

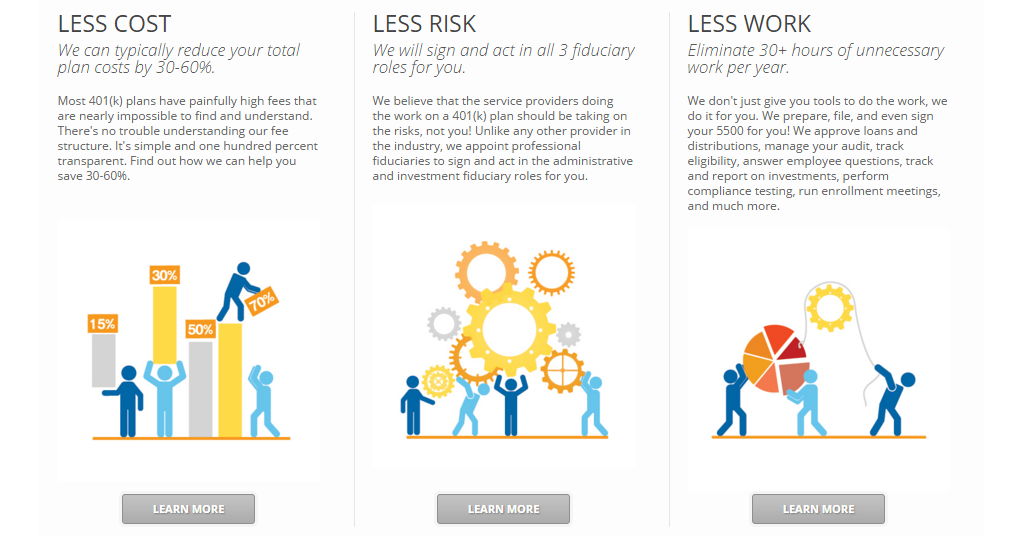

The traditional 401(k) model is broken. Employers spend too much time on plan administration and assume too much liability only to provide a plan that is too expensive for employees. BenefitGuard is fixing that. Over the past few years, BenefitGuard has dissected a complex industry and developed a plan structure that will change the way employers approach 401(k) plans. Essentially, BenefitGuard signs and acts in the primary fiduciary roles on behalf of an employer. The result is a simple, yet sophisticated 401(k) plan for employers of all sizes that dramatically reduces cost, risk, and work.

This new model improves the 401(k) experience for employees, HR Managers, and company executives. Employees receive the benefit of lower fees and consequently 20-30% more retirement savings over time. HR Managers save an average of 30 hours per year by outsourcing day to day plan administration and oversight. And executives no longer have to worry about the fiduciary risks associated with 401(k) lawsuits or government audits often triggered by the difficulty of complying with complex ERISA regulations.

Stage

Failed

Platforms

- Website/Web app

Published

March 09, 2016